The global digital ad market is expected to reach $870.85 billion by 2027, with agencies managing a significant portion of this spending. However, many still rely on outdated financial processes, fragmented tools, and inefficient billing cycles that cost them time and money. Canadian startup Opal is bringing modern financial infrastructure to agencies, addressing this inefficiency by eliminating credit risk, automating financial workflows, and unlocking cashback opportunities on ad spend.

Growth plans

The Saas platform designed to automate back-office operations for agencies has secured $1.5 million in pre-seed funding. The round was led by Founders Co-op with support from Exit North Ventures.

This investment will accelerate Opal’s mission and bring to market Opal Spend, the industry’s first purpose-built ad-spend solution that seamlessly integrates ad spend, accounting, and invoicing in one unified system. In addition to this, Opal plans to expand its capabilities, deepen platform integrations, and hire across engineering, product, and customer success teams.

Eyes to build a bank for agencies

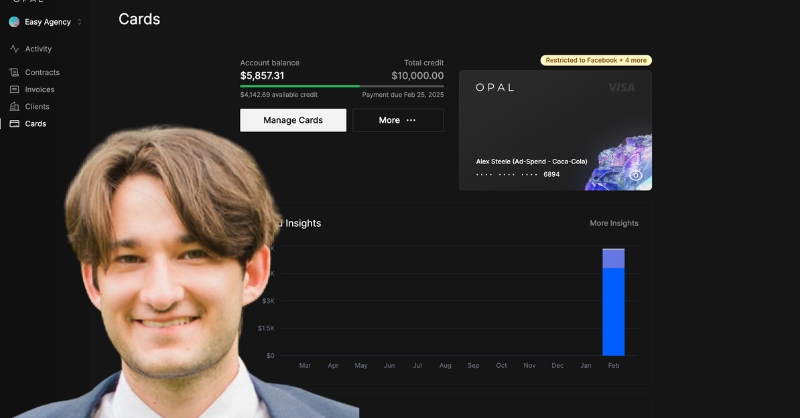

Founded in 2024 by Alex Steele, a former agency owner who faced firsthand the financial struggles these companies deal with. Founded to solve billing headaches at his media buying agency, Easy Agency, Opal offers an all-in-one platform that replaces fragmented, horizontal tools. The company’s long-term vision is to become the premier financial partner for media and creative agencies, unifying spend management, invoicing, and data-driven optimisation for a frictionless back-office experience.

Since launching, the company has grown 400% and attracted top engineering talent, including a team of former X engineers. Since launching, Opal has attracted top engineering talent, including recruiting former X engineers. By automating tedious and repetitive workflows into a single platform, the company enables agencies to close deals faster and focus on creating value for clients.

This new approach addresses many shortcomings in existing ad spend solutions, such as disorganised account statements, lack of customer-segmented cards, and insufficient finance automation. By housing all these capabilities under one roof, agencies gain streamlined workflows that eliminate manual data entry, expedite invoicing, and simplify reporting—while also capturing cash-back rewards as a new profit source. Larger advertisers can take advantage of the same tools to retain budget ownership and maintain comprehensive visibility over their expenditures and campaign performance.

0 Comments