March 29, 2025 – The Federal Reserve’s preferred inflation measure rose more than expected in February, signaling that price pressures remain persistent despite efforts to cool the economy. According to data released by the Commerce Department on Friday, the core personal consumption expenditures (PCE) price index climbed by 0.4% for the month, marking the largest monthly increase since January 2024.

This increase pushed the annual core inflation rate to 2.8%, surpassing the 2.7% that economists surveyed by Dow Jones had predicted. Core inflation excludes volatile food and energy prices, making it a more accurate reflection of underlying inflation trends.

Monthly and Annual Inflation Figures

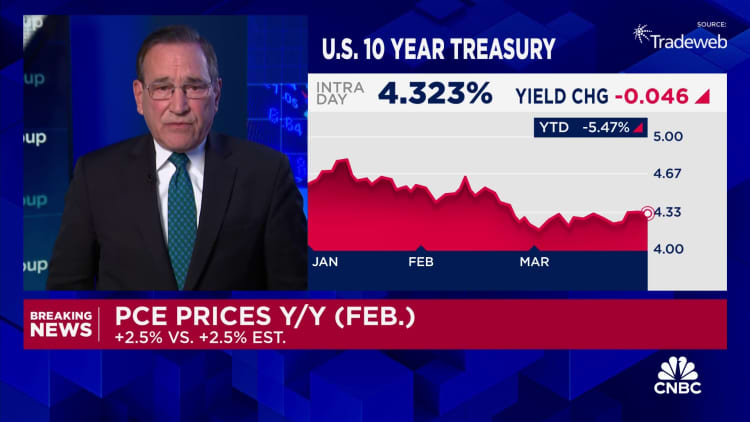

In addition to the rise in core inflation, the overall PCE price index, which includes all items, registered a 0.3% increase for the month and a 2.5% rise from a year ago. These figures were largely in line with market expectations, but the higher-than-expected core inflation suggests that price pressures in key sectors are proving difficult to contain.

Shelter costs, a critical component of inflation, increased by 0.3% in the PCE measure. Housing and shelter costs have been among the most persistent factors driving inflation, contributing significantly to the overall inflationary environment.

Consumer Spending and Personal Income Growth

The report also highlighted that consumer spending increased by 0.4% in February, slightly below the 0.5% forecast by economists. This modest rise in spending suggests that consumers remain resilient despite the ongoing inflationary pressures, although spending growth was somewhat weaker than anticipated.

At the same time, personal income rose by a robust 0.8%, doubling the expected growth of 0.4%. The sharp increase in personal income could provide consumers with additional spending power in the coming months, potentially sustaining demand and contributing to ongoing inflation concerns.

Market Reaction and Implications

The release of the inflation data led to a brief dip in stock market futures and Treasury yields, reflecting investor concerns that persistent inflation could delay the Federal Reserve’s plans to ease interest rates. Market participants have been closely watching inflation indicators as they assess the likelihood of future rate adjustments by the Fed.

While the latest PCE data did not indicate a dramatic spike in inflation, the continued upward trend suggests that the Fed may adopt a more cautious approach before considering any interest rate cuts.

Federal Reserve’s Perspective and Policy Outlook

The Federal Reserve places significant emphasis on the PCE inflation measure because it accounts for changes in consumer behavior and provides a more comprehensive picture of price pressures. Compared to the Consumer Price Index (CPI) reported by the Labor Department, the PCE index gives less weight to housing costs and focuses more on the broader economy.

Given the latest figures, analysts believe the Fed is likely to maintain its current stance of waiting for more consistent signs of inflation easing before adjusting interest rates. Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management, noted that while February’s inflation reading was higher than expected, it was not alarming enough to prompt immediate action from the Fed.

“It looks like a ‘wait-and-see’ Fed still has more waiting to do,” Zentner said. “Today’s higher-than-expected inflation reading wasn’t exceptionally hot, but it isn’t going to speed up the Fed’s timeline for cutting interest rates, especially given the uncertainty surrounding tariffs.”

Tariff Concerns Add Complexity to Fed’s Decision-Making

Complicating the Fed’s decision-making process is the uncertainty surrounding potential tariffs that could be imposed by President Donald Trump’s administration. Economists warn that additional tariffs could exacerbate inflation by raising the prices of imported goods, making it even more difficult for the Fed to bring inflation back to its 2% target.

“If new tariffs are implemented, we could see another wave of price increases that would put upward pressure on inflation,” said a senior economic analyst. “This would make it challenging for the Fed to justify rate cuts in the near term.”

Long-Term Inflation Expectations Remain Elevated

The persistence of higher-than-expected inflation has also influenced long-term expectations. Consumer surveys, including the University of Michigan’s Survey of Consumers, show that inflation expectations for the next five years have risen to 4.1%, reflecting concerns that price pressures may remain elevated for a prolonged period.

These long-term inflation expectations play a critical role in shaping consumer and business behavior, as they can influence wage demands, pricing decisions, and overall economic dynamics.

Challenges Ahead for Policymakers

The latest inflation data presents a challenging landscape for policymakers, who must navigate the delicate balance between containing inflation and supporting economic growth. The Fed’s primary focus remains on achieving price stability, but higher-than-expected inflation readings may force officials to delay potential interest rate cuts until clearer evidence of cooling inflation emerges.

For consumers, the rise in inflation means continued pressure on household budgets, even as personal income growth provides some relief. As the Fed assesses the evolving economic landscape, all eyes will remain on future inflation reports and their implications for monetary policy.

Outlook for the Coming Months

With core inflation running above expectations and consumer spending showing signs of resilience, the Federal Reserve is likely to maintain a cautious approach in the coming months. The possibility of higher tariffs, combined with persistent price pressures, suggests that any decision to cut interest rates may be delayed until a clearer and more sustainable downward trend in inflation becomes evident.

As the Fed navigates these complexities, the focus will remain on managing inflation expectations while ensuring that economic growth remains on a stable trajectory.

0 Comments