Central banks around the world, including the Bank of England (BoE) and the Federal Reserve (Fed), are navigating a delicate balancing act as they grapple with slowing economic growth and stubborn inflation.

Bank of England Holds Rates Steady

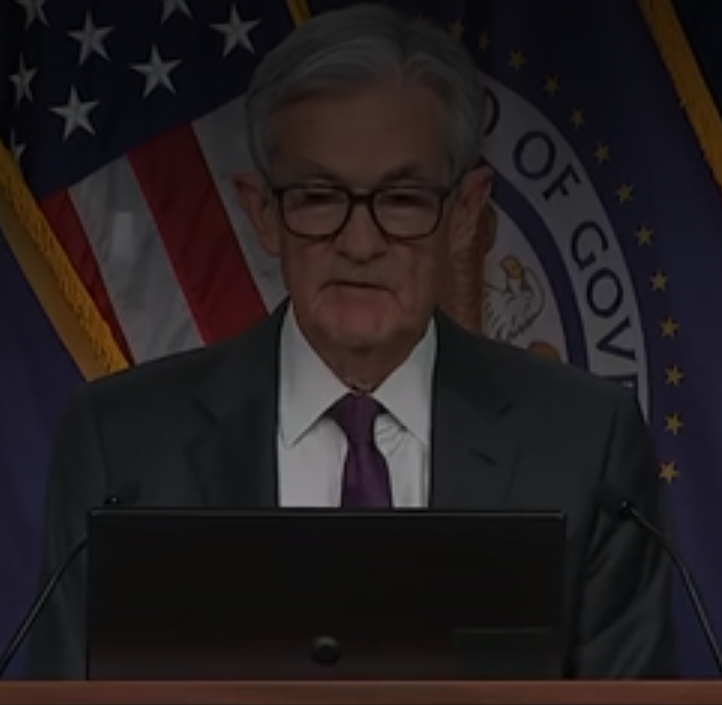

The BoE decided to hold interest rates steady, reflecting a cautious approach amid concerns over persistent inflation. This move mirrors the Federal Reserve’s decision a day earlier to keep rates unchanged as US inflation remains above target despite a cooling economy.

Stubborn Inflation a Global Challenge

Despite signs of slowing growth, inflation continues to remain sticky in key global economies, prompting central banks to maintain tight monetary policies.

- UK Inflation: Inflation in the UK, while easing slightly, remains above the BoE’s target, prompting policymakers to delay any rate cuts.

- US Inflation: Similarly, the Fed’s decision to keep rates steady reflects concerns over inflation resilience, despite signs of economic slowdown.

Other Central Banks Follow Suit

Other major central banks, including the European Central Bank (ECB) and the Bank of Canada, have also opted for a wait-and-watch approach, wary of cutting rates too soon in the face of inflationary pressures.

Risk of Prolonged Slowdown

Economists warn that maintaining high rates for an extended period could prolong economic slowdowns and increase the risk of recession, but central banks remain committed to their inflation targets. As global economies tread this fine line, markets remain on edge, closely watching for signals of future policy shifts.

0 Comments